- Nov 19, 2014

- 9,225

- 14,958

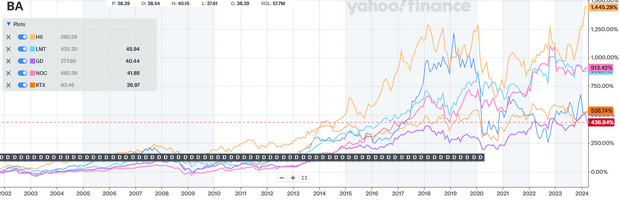

BA hit $199 today, I just sold all shares. Gonna sit on the sidelines for a while - I'm about 55% invested and 45% cash in my brokerage and Roth; about 85% cash/fixed in my TSP.

Nice trade. I have not added in a bit to anything. My indicators have us overbought, but markets can remain irrational longer than we can remain solvent. So I will wait and participate in the gains on the stuff I have. And should we get a 20+% drawdown I will spur into action.