- Jun 12, 2014

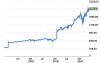

- 9,611

- 25,537

Founding Member

next time she has a hot tip, can you share it with us?

nice job by her, and by whom ever got her interested in investing at such a young age.

I forgot to mention... the other "odd" pick to me of hers that also done really, really well is CELH. Basically an energy drink. She likes to rub my nose in that one too. Brat

Have you received the call from the elementary school to say your daughter is extorting fellow students by making loans at usurious rates?

Have you received the call from the elementary school to say your daughter is extorting fellow students by making loans at usurious rates?