This is from a financial blog I read, a different take on the real estate forecast:

Why the Real Estate Boom Has a Decade to Run

Lately, I have been getting a lot of calls from concerned readers worried that we might be going into another 2008-2011 style real estate crash, when home prices cratered by 50%-70%, once the pandemic ends.It’s not going to happen and there are a dozen reasons why. Worst case, I expect a short, shallow pause in the market, followed by a ballistic move to new all-time highs.

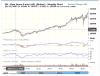

If you had any doubt, look no further than the superheated bond market which took interest rates to new all-time lows, sparking a refi boom in the process.

You see, there is a method to my madness.

Apple (AAPL) is planning on building a second new research and development campus that will need 20,000 new high-tech workers. Google (GOOGL) plans to spend $13 billion on real estate acquisitions, and Amazon (AMZN) just flushed out of New York, will move those 25,000 jobs to more hospitable climates.

It is all fresh fuel for a continuation in the bull market for US residential real estate, not just for this year, but for another decade, or more. More high paying jobs means more big spending home buyers.

Although prices seem high now, I am convinced that we are only at the beginning of a long-term secular bull market in housing. If you don’t believe me, check out the sky-high prices in Shanghai, Vancouver, and Sydney Australia.

Anything you purchase now is going to make you look like a genius ten years down the road.

The best is yet to come.

The big driver will be demographics, of course.

From 2022 onward, 65 million Gen Xers will be joined by 85 million late-blooming Millennials in a bidding war for the same houses. That will create a market of 150 million buyers, unprecedented in the history of the American real estate market.

In the meantime, 80 million baby boomers, net sellers, and downsizers of homes for the past decade will slowly die off and disappear from the scene as a negative influence. Only one-third are still working.

The first boomer, Kathleen Casey-Kirschling, born seconds after midnight on January 1, 1946, just turned 75 years old. A former schoolteacher, she took early retirement at 62.

The real fat on the fire here is that 10 million homes went missing in action this decade, thanks to the financial crisis. They were never built.

This is the result of the bankruptcy of several homebuilding companies and the new-found ultra-conservatism of the survivors, like DR Horton (DHI), Lennar Homes (LEN), and Pulte Group (PHM).

Did I mention that all of this makes this sector a screaming “BUY”?

Talk to any real estate agent and they will complain about the shortage of inventory (except in Chicago, the slowest growing market in the country).

Prices are so high already that flippers have been squeezed out of the market for good. Bottom feeders, like hedge funds buying at the bankruptcy auctions, are a distant memory. Some, like BlackRock (BLK), now own more than 40,000 homes and are the biggest landlords in the county.

And let’s face it, ultra-low interest rates aren’t going to be here forever. Borrow at 3.0% today against a long-term 3.0% inflation rate, and you are essentially getting your house for free.

The rising rents that are turning Millennials from renters to buyers may be the first sign of real inflation beyond the increasingly dear healthcare and higher education that we’re are already seeing.

And Millennials are having kids that demand a bigger living space! Who knew?