- Nov 12, 2017

- 1,602

- 3,947

As a "older" millennial, I have largely been investing in broad index funds in the stock market, real estate and more recently crypto currency. I have a decent amount of cash left inside a roth IRA and I have physical gold / physical silver available for purchase at my broker.

I was always thinking of putting a small amount of my portfolio into precious metals, gold and silver. Their prices seem to have come down some.

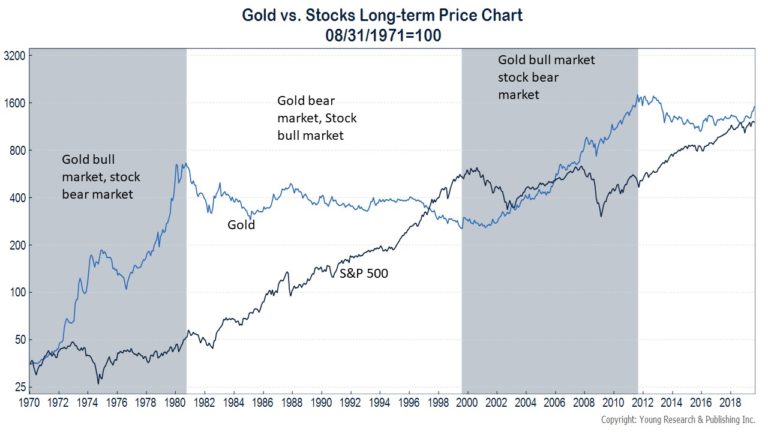

I am looking at Silver, its ATH was nearly $50 in the 70s and now it is trading for half that amount. Wtf. That is horrific taking into account inflation. Gold does not seem to be a whole lot better.

I would like to have them as a hedge against a market selloff and inflation, but Silver has been horrific against inflation, and Gold is not a whole lot better. What am I missing here?

Don't need financial advice. Just need a boomer to explain the bullish case for precious metals. The minimum return I should expect from any investment is at the very least keep up with inflation.

I was always thinking of putting a small amount of my portfolio into precious metals, gold and silver. Their prices seem to have come down some.

I am looking at Silver, its ATH was nearly $50 in the 70s and now it is trading for half that amount. Wtf. That is horrific taking into account inflation. Gold does not seem to be a whole lot better.

I would like to have them as a hedge against a market selloff and inflation, but Silver has been horrific against inflation, and Gold is not a whole lot better. What am I missing here?

Don't need financial advice. Just need a boomer to explain the bullish case for precious metals. The minimum return I should expect from any investment is at the very least keep up with inflation.

Last edited: