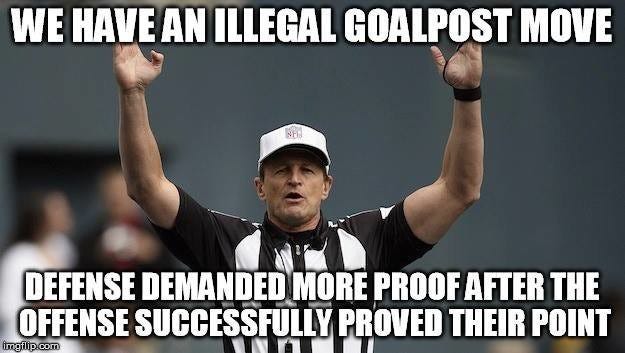

They did not MAKE 142 milllion in profit. That is the bottom line.

This is about facility additions and we only got around 8 million in major gifts last season. You pay for new facilities with profits , campaign contribtions and borrowing.

Brydman you are looking for an argument before looking at the facts...

Revenues are what you make

Expenses are what are taken out (COGs, Overhead, etc...)

Net is what you keep.... your net could be a profit or a lose...

So Donkey is 100% accurate in saying we make 142 million,

Just like saying we took at net loss for 2016-2017 of $4.079 million.

Our final net position was 153,372 (in thousands).