Brad, your father was younger than my dad(passed in 2013 at 83) but cut from the same cloth. Being born right during the Great Depression, his family bartered fresh grown vegetables and fixed other people's cars/machinery in exchange for hogs, chickens, eggs, milk and other essentials like clothes and shoes.

They were later able to buy a small farm where my Dad lived until serving post WW2. He never forgot that as he raised us either......always sacrificing by driving cars until you could see the road through the floorboards. Clothes were hung out on a cloths line and my mother pressed dads shirts and pants instead of dry cleaning. Torn pants meant we got a patch instead of a new pair.....Dad was a self-taught Quality Control Engineer for a government military defense contractor, but I think he was prouder of his prowess as a Domestic Master African Engineer with nearly anything that broke around our house....

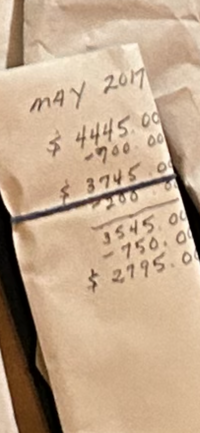

After his passing my brother and I were named as co executors of family trust by my mother and it has taken us with the help of my mother almost 10 years to go through all of the hand written ledgers and notes. We knew my mother had used about 600K in keeping my dad at a nursing home for 6 years after his stroke until he passed. Knowing how much she had spent of his, pension/401K/IRA I really didn't believe there would be more than a few hundred grand left besides the paid off 3/2 house which he bought cash in 1979 for $58K.... then we found the Bond/CD ledger......holy fuk

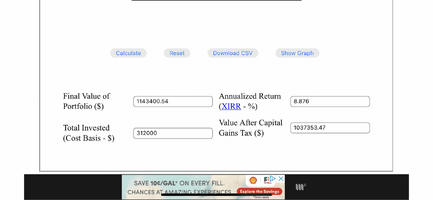

He had no stock holdings outside of his retirement accounts but stuffed every nickel he had into Bonds and CD's starting in the 1970's. Keep in mind rates back then were anywhere between 7-18% pretty much tapering down until the mid 2000's.

Needless to say we were off by somewhere between 5-6X our estimated value of the trust contents.....Yet the pair of shoes my Dad had just put on his feet before having a massive stroke at 5.30AM on his way out the door to go to work AT 78 years old nearly had holes in the soles.

:max_bytes(150000):strip_icc()/ctr.asp-Final-3b56dede387f4795bd961131141a9af4.jpg)

www.investopedia.com

He had no stock holdings outside of his retirement accounts but stuffed every nickel he had into Bonds and CD's starting in the 1970's. Keep in mind rates back then were anywhere between 7-18% pretty much tapering down until the mid 2000's.

He had no stock holdings outside of his retirement accounts but stuffed every nickel he had into Bonds and CD's starting in the 1970's. Keep in mind rates back then were anywhere between 7-18% pretty much tapering down until the mid 2000's.