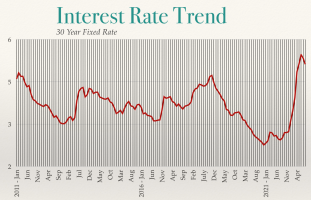

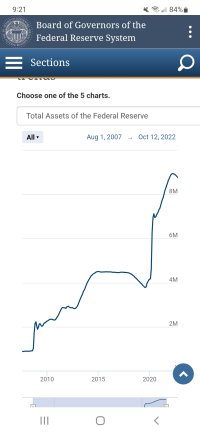

There's very little chance we'll be lowering rates by February. We might stop raising rates, but it's very unlikely we would lower them.

Personally I see them continuing to go up if we don't get more aggressive with tightening.

I do not disagree. I think the rush by cash buyers for homes might be true, but given higher rates, the ability for them to resell will be very limited. Again not predicting a crash but as an example I am seeing 20+% asking price drops here, granted from stoopid ask prices, but still. Properties that sold in 3 days now sitting 3 months later.

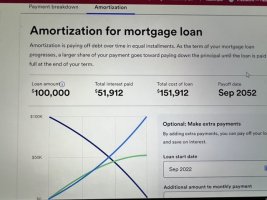

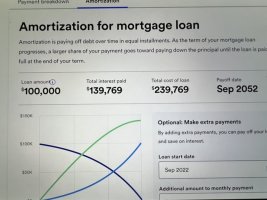

Speaking of rates, the investing thread has been quiet, guess b/c stocks are awful, gold it dead. crypto whatever has lost its volatility and the 1 year Treasury is sniffing 5%. Crete drops 2M into the 1 year, heads off to the Caymans and pulls in just under 100K for the year. Not bad work if you can get it,