They don't need crypto as a workaround to trade with countries that aren't participating in sanctionsWhy? Add up the populations of the undeveloped/underdeveloped world along with China's, India, Russia, and the ME...the population split is somewhere close to 80/20. We will be a severe minority and trying to wave the big stick(dollar) around to control all those people will leave us stretched too thin....we are becoming the new Europe and other countries will be laughing at us holding up our solar powered cars and houses while they use whatever means they can to build what we used to have here.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Buckle up, the crash is sooner rather than later

- Thread starter CaribGator

- Start date

So this is interesting...Rep Alex Mooney (W Va) is set to introduce a bill that puts the dollar back to a gold standard and requires to have the Fed disclose where all the gold assets have gone....boom

Meanwhile dwindling tax dollars will be sent to Ukraine and Europe to "rebuild" ....just wait until the "off balance sheet" derivatives blow up around the same time...... but don't worry about the criminals of the world(politicians like Biden and the RINO's)....they're already well positioned

but don't worry about the criminals of the world(politicians like Biden and the RINO's)....they're already well positioned

but don't worry about the criminals of the world(politicians like Biden and the RINO's)....they're already well positioned

but don't worry about the criminals of the world(politicians like Biden and the RINO's)....they're already well positioned

Last edited:

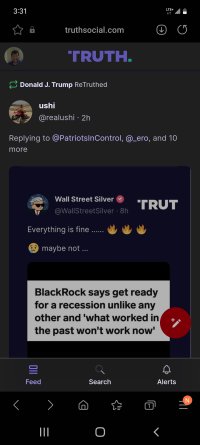

My graphic was re-truthed by 45 by the way so he is telling us the crash is coming sooner as opppsed to later

Central banks are buying gold in record amounts and BRICS nations seem to be aligning to go with crypto or at the very least breaking away from the globalist central bank system. Both sides seem to know the crash and subsequent transition are imminent.

Elevated interest rates here we come (good)

May not be the whole system (yet), but SIVB. Stock halted this AM at sub $40/share. Was $260/share TWO days ago. Was $600/share one year ago. And this is a fully chartered bank, Trying to raise money not going well, so announce they are trying to sell. Sounds like the FED will be taking over soon?

Last edited:

Is SIVB the new Lehman Brothers?May not be the whole system (yet), but SIVB. Stock halted this AM at sub $40/share. Was $260/share TWO days ago. Was $600/share one year ago. And this is a fully chartered bank, Trying to raise money not going well, so announce they are trying to sell. Sounds like the FED will be taking over soon?

Well that was quick. The FDIC has already put SIVB in receivership.Is SIVB the new Lehman Brothers?

Is SIVB the new Lehman Brothers?

Fortunately, no: there are some parallels (SVB bought bonds at the wrong time, essentially), but it's different from the MBS loans that went bad.

This will affect the tech sector--badly--though since they were so integral to the tech financing scene. If your portfolio is heavily invested into tech stocks, it could be a rough year.

So we’re in trouble.

Too early to tell.

A bunch of tech workers are going to be on shakey ground--and that's a sector that's been hit hard already in the last 6 months.

As for how this affects everyone else, much of the last 10-15 years of stock market growth has been from the tech sector, so returns and dividends are going to go down (though other areas of the economy have continued to stay strong, so who knows).

If this is a one-off, probably not too worrisome. But "moral hazard" may start trending again.So we’re in trouble.

I understand that the prevailing thought would be to honor all business and personal bank accounts and make them whole, but the little signs all over the bank's lobby says FDIC insured, meaning up to 250K per account. Therefore, i.e., eg, FVKK you, have many different accounts or use a number of different banks. Be responsible for what you can control. You could not control the bank's implosion. but if you had billions like some of the company's had, then do biz at JPM or BAC where the deposit base is huge and diversified.

ROKU has 487 LARGE (million) at SIVB.

www.cnbc.com

www.cnbc.com

Roku says 26% of its cash reserves are stuck in Silicon Valley Bank

Around $487 million of Roku's cash reserves are stuck at Silicon Valley Bank, the streaming media company said Friday.

Last edited:

Users who are viewing this thread

Total: 3 (members: 0, guests: 3)