- Sep 4, 2014

- 21,478

- 80,326

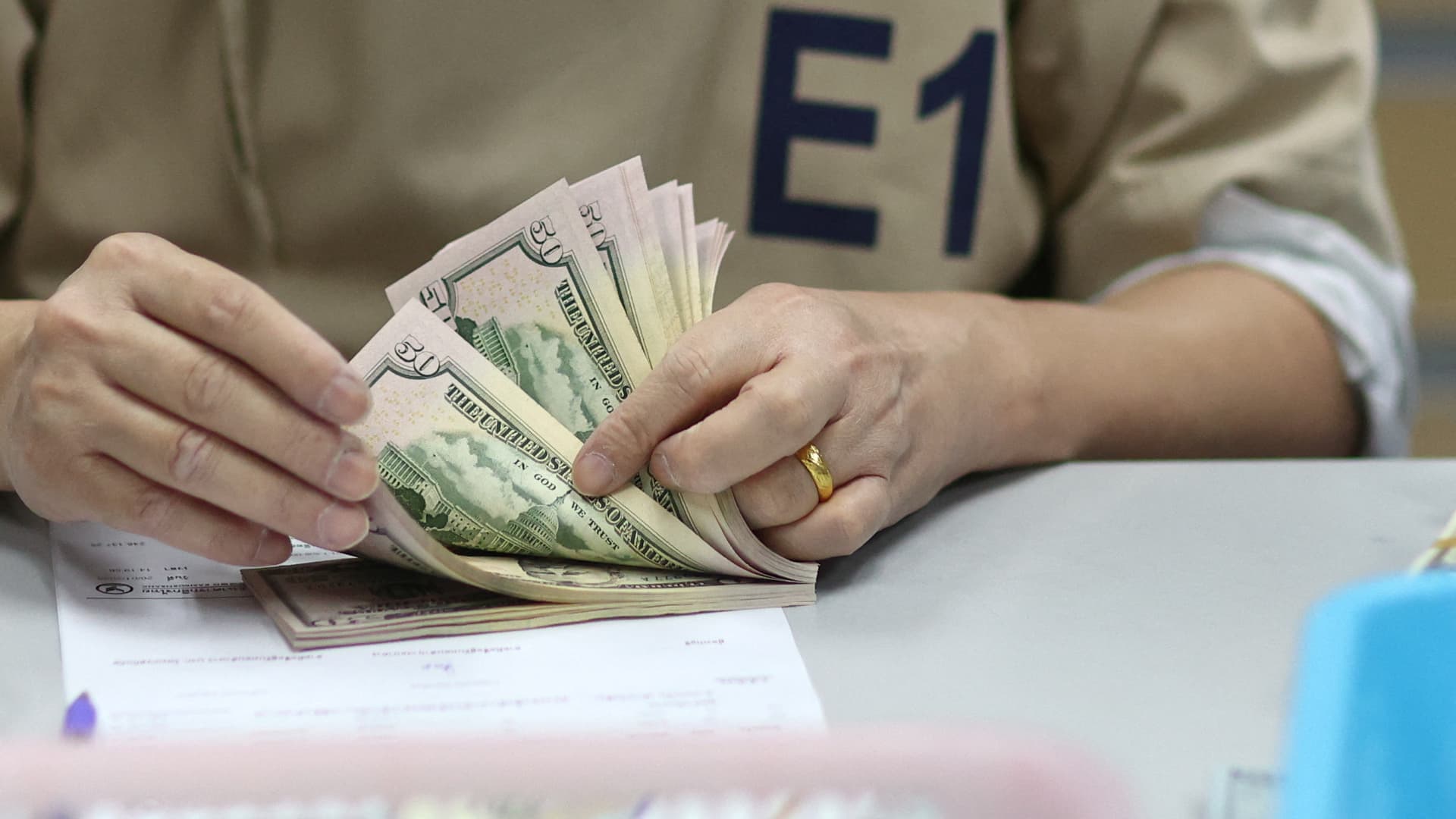

Consumer debt hits record $16.9 trillion as delinquencies also rise

Debt across all categories totaled $16.9 trillion as balances rose across all major categories.www.cnbc.com

Mortgage and auto are important, but it’s the unsecured debt that’s insane. Still not sure how it’s possible that between being forced to stay home(no dinners, movies, vacations, etc) for a year plus—over two in some areas—getting thousands in stimulus and enjoying historically low rates for much of that time, these people are still sitting on that type of credit card debt.

Maybe it’s just the time window of when they looked. I put everything on Amex and pay it once a month around the 5th. Maybe that’s what happened here.