- Jul 29, 2014

- 22,202

- 23,462

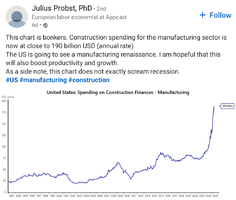

I could be wrong but I think the real issue here is the Treasury's back is against the wall with what's going on in regional banking sector...about 80% of them are technically insolvent and in the case of more failures they won't be able to do what they just did for the 4 that have failed since March....print hush money and give it to Jamie Demon and Chase to purchase them......

Yes if the Treasury cannot operate for a period of time during another failure the contagion could literally cause a banking demolition.....This is the reason Grandma Yellen is looking like she sh!t her Depends when she mentions June 1st...

Yes if the Treasury cannot operate for a period of time during another failure the contagion could literally cause a banking demolition.....This is the reason Grandma Yellen is looking like she sh!t her Depends when she mentions June 1st...